How To Register A Trading Company In Beijing Without Agent

By Eunice Ku and Rosario Di Maggio, Dezan Shira & Associates

Mar. 29 – When an international company has reached a sure level of success in selling to or trading with China, or only wants an on-the-ground presence in the country, it is common that a trading visitor is established in the course of a foreign-invested commercial enterprise (FICE).

Mar. 29 – When an international company has reached a sure level of success in selling to or trading with China, or only wants an on-the-ground presence in the country, it is common that a trading visitor is established in the course of a foreign-invested commercial enterprise (FICE).

The FICE structure has become the most common blazon of legal entity that foreign investors plant in China, as information technology is the virtually convenient, adequate and toll efficient type of business organisation structure available for foreign traders wishing to conduct the following activities:

- Expand their sourcing platform and take directly care of logistics and quality control

- Buy for the purpose of reselling finished or semi-finished products in China as an intermediary betwixt Chinese suppliers and foreign Cathay-based clients

- Import appurtenances to Cathay to sell directly, either in wholesale or retail

- Establish a fully operational China sales and after sales platform

- Deed every bit a business back up and liaison office for their overseas headquarters, including setting up other branches and employing staff on a national ground.

Beingness consistent with the WTO commitments Communist china agreed to in 2001, the Chinese authorities created the framework for FICE to operate in 2004 with the promulgation of the Administrative Measures for Strange Investment in the Commercial Sector ("FICE Measures").

The measures embrace Sino-strange disinterestedness/cooperative joint ventures also equally wholly foreign-owned enterprises (WFOEs) engaged in domestic retail, wholesale, commission bureau, or franchising businesses. The FICE Measures removed previous restrictions on the establishment of wholly foreign owned trading entities.

A FICE is relatively easier to ready compared to a full manufacturing WFOE as the capitalization requirements are typically lower due to the absence of whatever imported machinery or tooling requirements. They are also more cost effective than representative offices.

Yet, from a legal, tax and bookkeeping perspective, to institute and run a FICE requires both technical and administrative local knowledge.

It is important to ensure that the business model is feasible, that the strange investor has a full understanding of the registration and post-registration procedures, company greenbacks flows, and internal control processes.

Scope Covered

A FICE refers to a foreign-invested enterprise (FIE) that engages in the following activities:

- Retailing: i.e. selling goods from fixed venues or via television, telephone, postal service order, internet, and vending machines, and related services.

- Wholesaling: i.e. selling goods to retailers and industrial, commercial or other customers and other wholesalers, and related services.

- Franchising: i.e. authorizing the use of trademarks, merchandise names and operation models for remuneration or franchise fees through conclusion of contracts.

- Commission bureau activities: i.east. acting as sales agent, broker or auctioneer for appurtenances, or as wholesaler charging fees and conducting sales for others' goods and related services on a contractual footing.

There are 2 main types of FICE: retail FICE and wholesale FICE.

Retail FICE can, upon permission, appoint in:

- Retail of goods;

- Import of appurtenances dealt in by the FICE itself;

- Purchase of domestic products for export; and

- Other relevant ancillary business concern.

Wholesale FICE can engage in:

- Wholesale of goods;

- Commission agency (except auctioning);

- Import and consign of appurtenances; and

- Other relevant ancillary business.

A FICE can authorize others to open stores by style of franchising.

Basic Set-upwardly Requirements

The foreign investor should meet the following criteria:

- Has a adept reputation

- Has not committed any acts in violation of Chinese laws, administrative rules or regulations

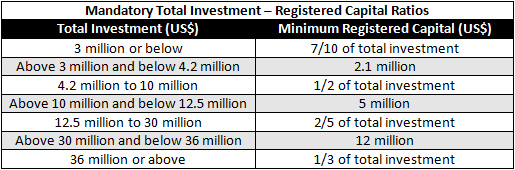

- Can meet the required ratio betwixt registered majuscule and full investment (meet accompanying Mandatory Full Investment – Registered Capital Ratios nautical chart)

Limitations

Limitations employ to FICEs dealing in specific products such as books, periodicals, newspapers, pharmaceutical products, agricultural chemicals, agricultural films, chemical fertilizers, processed oil, grains, vegetable oil, edible sugar and cotton wool. If a foreign investor has more than than 30 retail stores in China and distributes these products from different brands or suppliers, the foreign investor's share in a retail enterprise is limited to 49 per centum.

Retailing

Where the foreign investor wishes to use to open a shop concurrently with the establishment of the FICE, the proposed shop must conform to the urban and commercial development plans of the city where it is situated, and a certificate issued by the local government evidencing the same will be required.

In addition, for stores with business areas of or to a higher place 3,000 square meters, the foreign investor will exist required to submit a photocopy of the certification document for the right to use the land, and/or the premises lease agreement for the store.

Where a FICE that has already received permission to exist established applies to open a store, then in add-on to meeting the above requirements, it must also have undergone annual inspection on time and passed, and take paid up all of its registered capital.

The land to exist used by a FICE for opening a store must be commercial country obtained past ways such as public invitation for bids, auction, and listing in accordance with the laws and administrative regulations relating to state administration.

Franchising

For strange investors who would like to engage in franchising, they must also comply with the Authoritative Regulations on Commercial Franchise adopted by the State Council in 2007.

Term of Operation

The term of operation of a FICE should generally not exceed xxx years, whereas a FICE set up in the cardinal and western regions should generally not exceed 40 years.

Concern Scope Expansion

Where an existing FIE wishes to appoint in the commercial sector, it should better its articulation venture (JV) contract (applicable to JVs) and articles of association, fill out the relevant awarding forms, and submit them in accordance with the legal procedures for expanding an enterprise's business telescopic. The specific method of distribution (i.e., wholesale, retail or commission agency) should be specified, and the list of the relevant products should be attached.

Awarding Documents

The application documents for establishing a FICE are as follows:

- Written awarding form

- Feasibility report report jointly signed past all investors

- Contract, manufactures of association, and annexes thereto

- Each investor's banking concern credit certification, registration certification (photocopy), and legal representative certification

- Identity document if the investor is an private

- Each investor'south audit report in the most recent year audited by an accounting business firm

- Evaluation report for state-owned assets to be invested past the Chinese investor into a Sino-strange equity/cooperative JV commercial enterprise

- Catalog important and/or export bolt of the FICE

- List of members of the lath of directors of the FICE and the respective appointment messages from each investor

- Enterprise proper noun pre-approval observe enterprise issued past the authoritative section for industry and commerce

- For stores the size of 3000 foursquare meters or above, land use right certification document (photocopy), and/or lease understanding for the shop to be fix (photocopy)

- Document issued by the in-charge commerce section stating that the store is in compliance with the relevant provisions concerning urban development and urban commercial development

Where documents are not signed by the legal representative, a power of attorney must exist presented.

Portions of this commodity came from the March 2013 upshot of China Briefing Magazine titled, "Trading with Cathay." This issue of China Briefing Magazine focuses on the minutiae of trading with Communist china – regardless of whether your business has a presence in the country or not. Of special interest to the global small and medium-sized enterprises, this issue explains in particular the myriad regulations apropos trading with the almost populous nation on Globe – plus the inevitable tax, community and administrative matters that go with this.

Portions of this commodity came from the March 2013 upshot of China Briefing Magazine titled, "Trading with Cathay." This issue of China Briefing Magazine focuses on the minutiae of trading with Communist china – regardless of whether your business has a presence in the country or not. Of special interest to the global small and medium-sized enterprises, this issue explains in particular the myriad regulations apropos trading with the almost populous nation on Globe – plus the inevitable tax, community and administrative matters that go with this.

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business informational, revenue enhancement advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia's most versatile full-service consultancies with operational offices across China, Hong Kong, Bharat, Singapore and Vietnam as well as liaison offices in Italy and the United States.

For farther details or to contact the firm, delight email china@dezshira.com, visit www.dezshira.com, or download the company brochure.

Y'all can stay upwardly to date with the latest business and investment trends across Prc by subscribing to Asia Briefing's complimentary update service featuring news, commentary, guides, and multimedia resource.

Related Reading

Setting Up Wholly Strange Owned Enterprises in Cathay (Third Edition)

Setting Up Wholly Strange Owned Enterprises in Cathay (Third Edition)

This guide provides a practical overview for any business-minded individual to sympathize the rules, regulations and management issues regarding establishing and running a WFOE in China.

Hong Kong and Singapore Belongings Companies

Hong Kong and Singapore Belongings Companies

In this issue of China Briefing Magazine, nosotros take a closer expect at the benefits of both Hong Kong and Singapore holding companies, how to establish and maintain a company in each of these jurisdictions, and the relevant double tax agreements.

VAT General Taxpayer Status Important for FICEs

FICE Franchising in China: A Flourishing Business organization Model

Import-Consign Taxes and Duties in Red china

China'southward Import and Consign Licensing Framework

How to Sell to China – The Initial Evaluation Procedure

Source: https://www.china-briefing.com/news/establishing-a-trading-company-in-china/

Posted by: croninandeastras.blogspot.com

0 Response to "How To Register A Trading Company In Beijing Without Agent"

Post a Comment